Transitioning to renewable energy - can you afford to wait?

By Andre Nepgen

Delaying the transition to renewable energy might seem safe. But rising utility price hikes and looming carbon taxes, which will hit business profitability hard, make the transition more urgent.

Many businesses take a wait-and-see approach to renewable energy for various reasons, including lack of familiarity, regulatory and policy concerns, or business priorities. They defer procurement or adopt an incremental procurement strategy to get a firmer understanding of the market before committing.

This cautious approach is especially common with electricity wheeling, where renewable energy is generated offsite at the country's largest wind and solar plants and delivered to your business without any physical changes on site, unlike with embedded solar. While wheeling may feel abstract, it's not new. Eskom has been using the same wheeling framework to purchase renewable energy from private generators since 2011.

There are three reasons you should not delay transitioning your business to price-certain renewable energy.

1: Waiting will cost your business more

The first is a mathematical argument. Say your business is looking at a 20-year timeframe. Instead of taking out a 20-year contract on day one, you decide you're going to wait five years, and only then take out a fifteen-year contract. It's important to understand that if you wait five years, you'll have sacrificed those five years of savings.

Discovery Green has calculated that for every five years of delay, the price of renewable energy needs to drop by 20% for your decision to make economic sense.

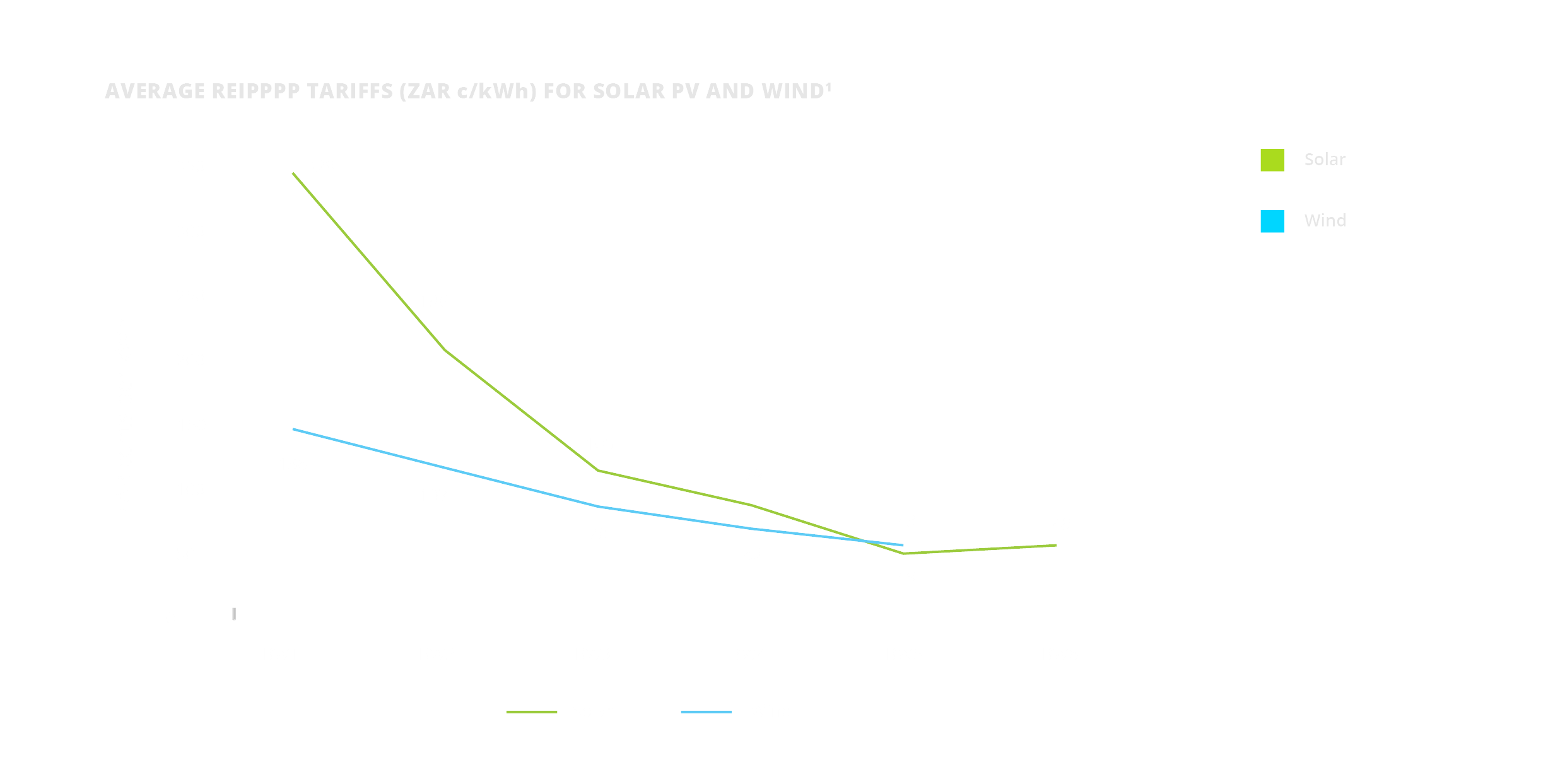

But renewable energy prices have actually levelled out over the past few years. We've seen solar prices plummet with new technologies over the past decade, and wind prices have also come down. But this trend has reversed in recent years, with solar prices in the government's Renewable Energy Independent Power Procurement Programme (REIPPPP) increasing for the first time ever.

*BW stands for Bid Window. BW1 took place in 2011, BW6 in 2022

Our analysis found that the price of renewables needs to drop by 20% over a five-year period. But a significant chunk of other costs in a renewable energy power plant (land, labour, legal and engineering, etcetera) are fixed. So, paying less for the solar panels themselves won't help much unless you have a 20% reduction in the overall project cost.

The argument always offered is that solar technology is improving, so costs are coming down. But the technology only constitutes about 50% of the total price impact. In actual terms, that means the cost of the technology would need to drop by 40% to make financial sense.

This levelling out of electricity prices, together with the limited potential for technology improvements to create further cost efficiencies, implies that further reductions in the price of renewable energy in South Africa, although possible, are probably difficult to achieve.

Another cost aspect to consider is the impact of carbon taxes. By 2034, businesses could find themselves paying four times more on electricity generation costs due to price inflation and carbon taxes, which are set to start increasing from 2026. While current tax allowances offer some relief - up to 95% depending on the sector in which your business operates - these allowances are expected to be phased out within the next decade.

While wheeling may feel abstract, it's not new. Eskom has been using the same wheeling framework to purchase renewable energy from private generators since 2011.

2: Waiting means settling for less optimal renewable sites

The second reason not to wait is that typically with renewable energy, your best solar and wind resources are in very remote parts of a country (it's especially the case in SA). We have great wind and solar resources in these areas, but very little industry.

Eskom has not put up substantial infrastructure in these areas because there has never been large electricity demand. But now with the burst of private renewable energy generators wanting to put up solar and wind farms in places with the most optimal resources, the Eskom infrastructure in these areas has become overloaded. This is because it hasn't been set up to take large volumes of electricity generation. The grid quickly reaches full capacity, which stops more renewable energy power plants from being built there and connecting to the grid.

This means that the second future tranche of energy generators wanting to start putting up plants in SA will have to consider less optimal areas in terms of solar and wind resources (where there is still grid capacity available). Any new renewable energy generation will have to settle for areas with less optimal solar and wind resources.

The most optimal, resource-rich locations across SA are being taken up by whoever gets there first. That's why we're saying that the longer you wait to enter the renewable energy market, when you do eventually enter the market, you're more likely to have to purchase renewable energy from power plants in less optimal locations. As the cost of the technology will still be the same, you can expect to pay a higher price for that renewable energy in the future.

There is greater risk for your business in waiting for a few years to see what the market looks like. At that point, it could be a wait of 5, 10 or 15 years to get access to the grid. That's the trend we've seen play out in developed markets such as the UK and US. So, it really is a ticking clock.

3: ESG demands and looming carbon taxes

There is also the impact on ESG commitments and market competitiveness to consider, seen in reporting obligations, and pressure from partners in the value chain. Businesses are paying more attention to their emissions and reporting on where these emissions are coming from. And these will be subject to carbon taxes. If you're a manufacturing business selling materials or products to another business, you're forming part of someone else's value chain as an upstream supplier.

You'll need to reassure those partners that your business is green because they'll also have reporting obligations and targets. If your emissions are high, they're going to look for other businesses to buy that product from - businesses who meet their emissions targets more efficiently.

This is why we strongly advise against delaying so your business won't run the risk of losing out on the savings currently available from renewable energy. Delaying the transition to renewable energy can have significant financial and operational consequences. Renewable energy in South Africa is an industry in transition. Can you afford to wait?

Andre is the Head of Discovery Green