Renewable energy models: The solution to rising electricity costs

As the utility price for electricity continues to increase yearly, with a 36.1% hike proposed for 2025, transitioning to affordable, price-certain renewable energy is a valuable long-term solution for businesses to manage their energy costs.

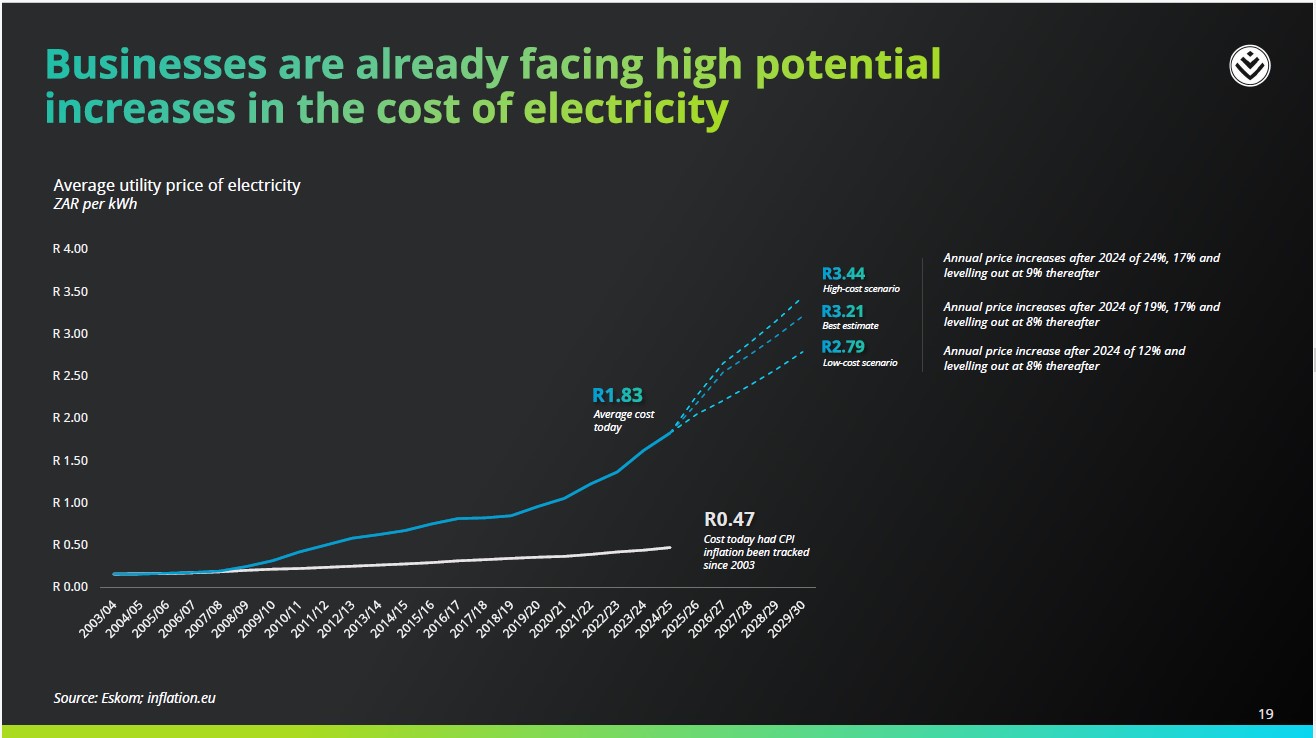

Since 2010, utility electricity tariffs have climbed by an average of 12.5% annually, outpacing the consumer price index (CPI) by 7.1% per year on average. What this means is that over 14 years, electricity costs have surged by 473% compared to consumer prices, which increased by only 117%. For business in energy-intensive industries, such as manufacturing and mining, these compounding increases have a negative impact on competitiveness and profitability.

Electricity prices - a growing burden on businesses

Eskom has stated that current electricity tariffs do not fully reflect the actual cost of generating and supplying power, including expenses such as fuel, maintenance, and infrastructure upgrades. Thus, as part of its strategy to reach a 'cost-reflective tariff', it has proposed a 36.1% hike for 1 April 2025, followed by 11.8% and 9.1% over the following two years. The National Energy Regulator of South Africa (NERSA) is set to decide on the proposed increase by late December 2024 or early January 2025. The state utility also argues that it needs the hefty increase because of the large outstanding municipal debt of R78 billion as of July 2024. However, back-to-back utility price increases of 18% from 2023 and 13% from 2024 have left businesses strained.

For many businesses, loadshedding was a catalyst to move to renewable energy. With the recent relief from loadshedding along with rapidly increasing electricity costs, the rationale for renewable energy procurement has quickly shifted from one of energy security to price security.

The business case for renewable energy

For businesses, transitioning to renewable energy is about more than meeting sustainability goals. It is a crucial financial move to shield against future price hikes and carbon taxes, along with ensuring immediate savings. Unlike utility tariff increases, which have been well above inflation, renewable energy provides long-term price certainty that protects profitability.

Research by Discovery Green shows that businesses with high energy requirements can achieve significant savings of 33% to 34% on generation costs just by switching to renewable energy. South African businesses have a choice of renewable energy models, including embedded (or 'onsite') solar, wheeled solar or wind, traditional aggregators, and renewable energy platforms. Each model offers different levels of coverage and selecting the right renewable energy model for your business is key to maximising savings and reducing risk. Here are some of the options:

- Embedded solar is typically solar panels installed on rooftops or available land nearby. Embedded solar offers limited renewable energy coverage, only replacing 8% to 39% of a business's energy requirements as generation fluctuates based on daylight hours and weather conditions. Embedded solar typically has a lower quoted price, making it a popular choice for businesses. However, as it provides the least renewable energy coverage, businesses are still reliant on their utility to supplement their remaining energy needs, leaving them exposed to the utility's tariff hikes.

- Wheeled solar and wheeled wind, where renewable energy is transported ('wheeled') from a generation site like a solar or wind farm through the country's electricity grid to the business. This model involves a shift in the place of renewable energy generation from the business's premises to areas in the country with the best solar and wind resources. Renewable energy wheeling offers 49% to 73% renewable energy coverage, depending on the generation technology and the electricity consumption of the business. Wheeled solar and wheeled wind typically have higher quoted prices than embedded solar, about 1.3 to 1.6 more according to our research. However, it leads to more savings for the business as a result of the greater protection from utility tariff hikes.

- Trader through aggregation allows businesses to access green energy from multiple renewable projects through an aggregator to meet 54% to 73% of their energy needs. By pooling demand from several customers, the aggregator model offers renewable energy supply at a competitive price and reduced exposure to utility tariffs. However, the model has drawbacks. Like wheeled solar and wheeled wind, it operates on a take-or-pay basis, requiring the business to pay for a minimum amount of energy, whether they use it or not. This passes most of the risk to the buyer.

- The platform model, such as Discovery Green, combines renewable energy from wind and solar farms. It also creates a portfolio of diverse businesses consuming the renewable energy, all within a centralised platform. The risk-sharing benefits of this model means it offers the highest coverage, 90% and more, giving businesses the strongest hedge against utility price hikes. The quoted price of this model is often higher than other options (1.3 to 1.7 times more than the quoted price for low-coverage embedded solar). However, in the long run, this model often leads to the highest savings scenario as businesses benefit from a stable energy supply, scalability, and minimal dependence on utility-supplied electricity.

Read more on renewable energy models

Get long-term electricity price stability

Partnering with a reputable company and selecting the optimal renewable energy model can help businesses avoid the risk of future above-inflation utility price increases and carbon taxes. This safeguards profitability and allows businesses to achieve their sustainability goals over the long-term.